ETH Price Prediction: Bullish $5,000 Target Amid Short-Term Turbulence

#ETH

- Technical Strength: ETH trades above key MA with Bollinger Band expansion signaling volatility.

- Institutional Divergence: Short-term ETF outflows offset by $1.62B spot purchases.

- Price Target: $5,000+ predicted despite validator exits and NFT market weakness.

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

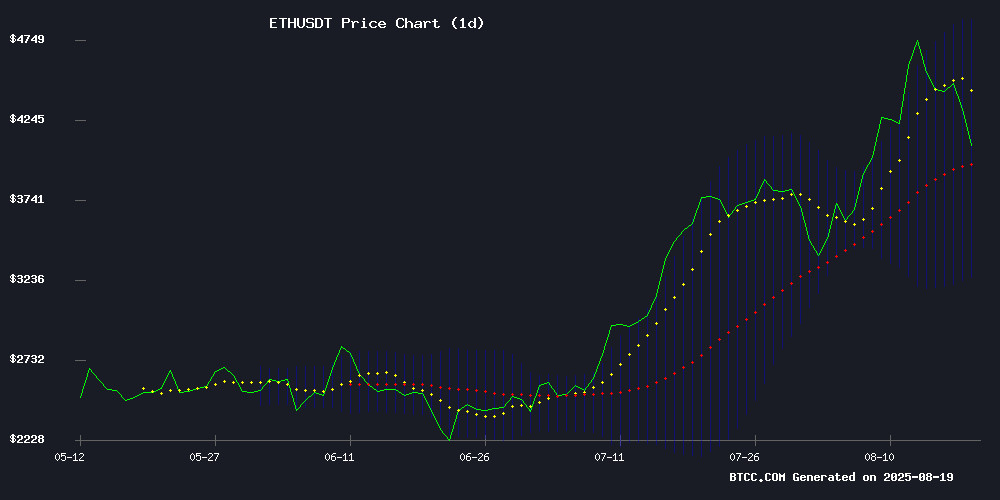

According to BTCC financial analyst James, ethereum (ETH) is currently trading at $4,291.59, above its 20-day moving average (MA) of $4,078.64, indicating a bullish trend. The MACD indicator shows a bearish crossover but with diminishing momentum (-124.79), suggesting potential reversal. Bollinger Bands reveal ETH is near the middle band ($4,078.64), with upper resistance at $4,897.62 and lower support at $3,259.66. James notes that a break above the upper band could signal a strong uptrend.

Mixed Market Sentiment as ETH Faces Institutional Outflows and Long-Term Confidence

BTCC analyst James highlights conflicting signals in Ethereum's market sentiment. While US Ethereum ETFs saw $196.6M outflows (second-largest daily redemption) and $3.9B ETH left the network via validator exits, institutional buyers acquired $1.62B worth of ETH. James states, 'Short-term uncertainty exists, but long-term confidence remains strong, especially with predictions targeting $5,000+.' The $4,200 support level is critical for near-term price action.

Factors Influencing ETH’s Price

US Ethereum ETFs See $196.6M Outflow, Second-Largest Daily Redemption Since Launch

Investors pulled $196.6 million from US spot Ethereum exchange-traded funds on August 18, marking the second-largest daily outflow since the products began trading. BlackRock's ETHA and Fidelity's FETH led the withdrawals, shedding $86.9 million and $78.4 million respectively.

The redemptions interrupted an eight-day inflow streak that had brought over $3.7 billion into Ethereum ETFs. Despite the setback, cumulative net inflows remain strong at $12 billion, reflecting growing institutional adoption. The funds now hold $27.7 billion in assets, representing 5.34% of Ethereum's total market capitalization.

Ethereum Sees Record Validator Exodus as $3.9B ETH Leaves Network

Ethereum's proof-of-stake network is experiencing an unprecedented validator exodus, with over 910,000 ETH—worth nearly $3.91 billion—queued for withdrawal. This marks the largest outflow in the network's history, dwarfing the 268,000 ETH awaiting entry. The validator queue, designed to balance staking dynamics, now holds nearly 2.5% of all staked ETH, requiring approximately 14.5 days to process at current speeds.

Early stakers are capitalizing on profits, having entered positions when ETH traded between $1,000-$2,000 versus today's $4,400+ prices. Simultaneously, institutional players are consolidating smaller validator slots into more efficient large-scale positions, reflecting maturation of Ethereum's staking ecosystem.

Ethereum Slides 6.5% to $4,259 as Bulls Test Key Support Levels

Ethereum's price retreated to the $4,200-$4,300 range after failing to sustain momentum above $4,600, with technical analysts flagging $4,000 as critical support. A breakdown could trigger further downside, while holding this level may reignite bullish momentum toward $4,600-$5,000.

Derivatives markets revealed over $210 million in Ethereum long liquidations amid a broader crypto selloff totaling $530 million. The unwinding of leveraged positions exacerbated the pullback, highlighting market fragility after recent rallies.

Spot Ethereum ETF flows continue to influence price action, with U.S. products launched in July 2024 improving institutional participation. The $4,200-$4,300 zone now serves as a battleground between bulls seeking higher targets and bears eyeing a retest of psychological support at $4,000.

Ethereum Eyes New All-Time High After $1.62 Billion Institutional ETH Purchase

Ethereum dipped to $4,378 amid a $1.62 billion institutional buying spree, signaling renewed investor confidence. Technical analysis suggests a potential rally toward all-time highs if the $4,100 support level holds firm.

ETH futures trading surged 114%, reflecting heightened market enthusiasm and liquidity. Despite a 3.32% daily decline, Ethereum's $522.99 billion market capitalization underscores its dominance.

Bitmine Immersion, led by Tom Lee, executed the massive ETH purchase, fueling bullish sentiment. Analysts highlight critical support levels as the key determinant for Ethereum's next major move.

Ethereum Outflows Signal Long-Term Confidence Amid Short-Term Uncertainty

Ethereum (ETH) has weathered a volatile week, maintaining its position above $4,400 despite a 7% late-week pullback from highs near $4,700. The cryptocurrency's 4% weekly gain masks underlying market tension, with derivatives data revealing a clash between short-term traders and long-term holders.

Nearly $888 million exited exchange wallets this week, with notable outflows from Binance and Coinbase. Such movements typically indicate accumulation by investors unwilling to leave assets on trading platforms—a bullish signal for ETH's fundamental strength.

Futures markets tell a different story. Open interest plunged 29% over two days as leveraged positions unwound, while perpetual swap funding rates turned negative. This derivatives pessimism creates a textbook contrarian setup: when speculators lean heavily short, sharp reversals often follow.

Arbitrum Price Eyes 50% Rally Amid DeFi Growth and Market Resilience

Arbitrum's native token has surged past $0.51, marking a 32% gain over three months while defying broader crypto market downtrends. The Layer 2 solution now flirts with a potential 50% upside toward $1.10, contingent on sustained DeFi activity and defense of the $0.50 support level.

On-chain metrics reveal compelling traction: 12.57% monthly growth in active wallets positions Arbitrum as Ethereum's closest competitor in user adoption. The network ranks second only to Ethereum in net USD inflows, signaling growing institutional confidence despite absent whale accumulation patterns.

Market technicians note the token's 4% daily surge breached critical resistance at $0.50, transforming previous ceiling into support. This technical breakout coincides with accelerating Total Value Locked (TVL) across Arbitrum's DeFi ecosystem, though analysts caution the rally requires sustained protocol adoption to maintain momentum.

NFT Market Cap Slides $1.2B as Ethereum Weakens and Penguins Rise

The NFT market cap contracted sharply, shedding $1.2 billion in under a week—a 12% drop that dragged total valuations to $8.1 billion. Ethereum's 9% decline from $4,700 to $4,260 directly impacted the sector, given most NFTs operate on its blockchain. Top collections like CryptoPunks and Bored Apes mirrored the downturn, with CryptoPunks alone losing $300 million in value and sales volume sliding 34% to $12.7 million.

Pudgy Penguins unexpectedly surpassed Bored Apes in market cap rankings despite a 17% drop to $491 million. Bored Apes, once the second-most valuable collection, tumbled nearly 20% to $482 million, signaling shifting investor preferences even amid broader market weakness. Ethereum's 4% weekly slide continued to pressure NFT valuations, reinforcing its pivotal role as the ecosystem's backbone.

While institutional interest persists, the sector faces headwinds from ETH's volatility. The reshuffle among leading collections underscores how relative strength can emerge during downturns, with Pudgy Penguins capturing attention as a standout performer.

BTCS to Pay First-Ever Ether Dividend, Loyalty Bonus to Discourage Short Selling

BTCS Inc., a Nasdaq-listed crypto strategy firm, announced a groundbreaking ether (ETH) dividend for shareholders. The one-time "Bividend" offers $0.05 per share, payable in ETH or cash, with an opt-in deadline of Sept. 26. A $0.35 per share loyalty bonus in ETH will reward long-term holders who transfer shares to the company’s transfer agent by January 2026.

The move targets short sellers by making shares harder to borrow. CEO Charles Allen framed it as a defensive strategy against dilution bets, noting the stock trades below its $6.65 per share book value. BTCS shares rose 7% to $4.71 on the news, outperforming crypto treasury peers.

Ether Market Braces for Volatility as $4.2K Support Hangs in Balance

Ether faces heightened liquidation risks below $4,200, with Hyperliquid data showing $236 million in long positions vulnerable at $4,170. A breakdown could trigger cascading sell orders, exacerbating ETH's 5% daily decline to $4,260.

Mechanism Capital's Andrew Kang warns of a potential plunge to $3,600 if $5 billion in leveraged positions unwind across exchanges. The decentralized derivatives market now serves as an early warning system for spot price movements.

Liquidation mechanics create reflexive selling pressure - forced position closures beget further downside, particularly in perpetual swap markets where ETH dominates trading volumes. Market makers are recalibrating delta exposure ahead of key technical levels.

Ethplorer Review: The Ethereum Explorer Powering Smarter Blockchain Tracking

Ethereum's ecosystem has evolved dramatically from its early ERC-20 days, now underpinning DeFi protocols, DAOs, and a sprawling universe of tokens. Ethplorer emerges as a critical tool for navigating this complexity, offering real-time transaction tracking, historical token analytics, and API integration.

The platform's notification system gains urgency amid Ethereum's Pectra upgrades, which enhance wallet functionality. Ethplorer stands out among blockchain explorers by catering to both casual users and developers seeking granular on-chain insights.

ETH Price Prediction: Targeting $5,000+ in Coming Weeks Despite Short-Term Pullback

Ethereum's recent pullback to $4,288 after testing yearly highs has sparked debate among analysts, with many viewing the dip as a buying opportunity rather than a sign of deeper correction. Technical indicators suggest temporary weakness before a bullish continuation, with multiple forecasts converging around the $5,000 mark.

DigitalCoinPrice has progressively raised its Ethereum forecast from $4,915 to $5,032 over three days, citing EMA indicators that show sustained bullish momentum. CoinEdition's analysis reinforces this outlook, identifying an upward-sloping channel with dynamic support near $4,723.

The short-term target for ETH stands at $4,750-$4,870 within one week, representing an 11-14% gain. Medium-term projections point to a $4,900-$5,200 range within a month. Key resistance at $4,869 remains the level to watch for bullish confirmation, while $4,053 serves as critical support.

Is ETH a good investment?

Based on current technicals and news, BTCC's James provides a nuanced outlook:

| Metric | Value | Implication |

|---|---|---|

| Price | $4,291.59 | Above 20-day MA ($4,078) |

| MACD | -124.79 | Bearish but slowing |

| Bollinger Bands | $3,259-$4,897 | Volatility expected |

| Institutional Flow | -$196.6M (ETF) +$1.62B | Net positive |

James concludes: 'ETH remains a high-conviction investment for bulls, though traders should monitor the $4,200 support. The $5,000 target appears achievable if institutional inflows persist.'